Venezuela’s Risk Unhinged

More on:

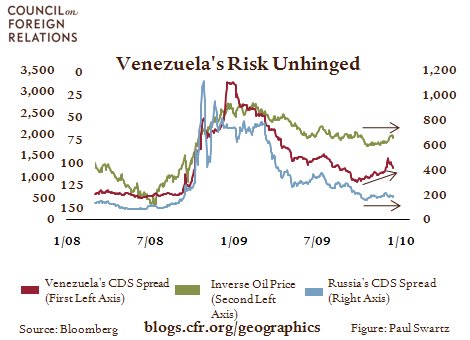

The credit risk of oil exporting countries such as Venezuela and Russia tends to move with the price of oil. As a country’s oil export revenue improves, so does its ability to pay its debts. Recently, however, Venezuela’s CDS spreads have increased even while the price of oil has been stable. The market’s perception of an increased risk of default coincides with the Venezuelan government’s move to close banks representing 8% of the country’s deposits. On Tuesday December 15th the Venezuelan National Assembly passed a law increasing depositors’ insurance in an effort to prevent a run on the banks. Problems in the financial sector have become the primary driver of Venezuelan sovereign credit risk.

Molinski: Venezuela Lawmakers Approve Bank Reform Plan

Carroll: Aides In Firing Line As Hugo Chávez Targets Bank Corruption In Venezuela

AFP: Venezuela Passes Banking Law Raising Govt Control

More on:

Online Store

Online Store